For businesses trying to streamline their accrual accounting, FinOptimal offers Accruer software and managed accounting companies. Accrued expenses are basic to accrual accounting, the popular method beneath Generally Accepted Accounting Principles (GAAP). In Contrast To cash foundation accounting, which solely acknowledges transactions when cash changes palms, accrual accounting data bills when they are incurred, regardless of when payment happens. Recognizing accrued bills ensures your monetary statements adjust to GAAP, giving stakeholders a dependable view of your organization’s financial performance. This adherence to standards builds belief and credibility with traders, lenders, and different key stakeholders. Accrued bills are a cornerstone of accrual accounting, a way that records revenues and expenses when incurred, regardless of when money modifications hands.

- Accrued bills are these costs your corporation incurs but hasn’t but paid.

- As a outcome, the accrued expense balance increases from the unpaid employee wages brought on by the timing mismatch.

- Cash bills, nevertheless, are recorded the moment the money leaves your account.

- In manufacturing, it tracks work-in-progress inventories, accruing costs as production advances, matching to gross sales upon completion.

- A few other examples of accrued costs/expenses are-A firm purchases supplies from a vendor however is yet to receive an invoice.

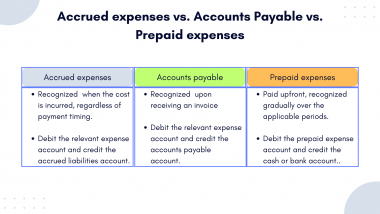

Accrued Expenses Vs Other Expense Sorts

Year-end procedures for accrued bills are much like month-end, however with a broader scope and larger significance. Year-end accruals are crucial for ensuring your financial statements precisely replicate the entire yr’s exercise. This is crucial for tax reporting, financial analysis, and making knowledgeable enterprise selections. A thorough evaluation of all accrued bills is critical, usually involving collaboration with completely different departments to assemble all the required information. This can additionally be the time to make reversing entries firstly of the new fiscal yr to keep away from double-counting expenses when the precise payments are made.

As A Outcome Of the corporate really incurred 12 months’ price of salary expenses, an adjusting journal entry is recorded at the finish of the accounting interval for the final month’s expense. The adjusting entry will be dated Dec. 31 and will have a debit to the wage expenses account on the revenue assertion and a credit to the salaries payable account on the steadiness sheet. Prepaid bills are payments made upfront for goods and companies which are anticipated to be supplied or used in the future. While accrued expenses symbolize liabilities, pay as you go bills are acknowledged as assets on the balance sheet.

This principle dictates that bills ought to be recognized in the same period because the revenues they generate. For example, if an organization earns revenue from promoting products in a specific quarter, the cost of the products bought (COGS) related to those products must also be recognized in that very same quarter. This matching of revenues and bills offers a more correct image of profitability and helps keep away from misrepresenting a company’s monetary performance. The accrual principle depends on both income recognition and matching rules, contemplating the timing of enterprise transactions. This cautious consideration ensures that financial statements precisely replicate the financial exercise of a enterprise. Accrued bills are some of the necessary ideas in accounting, significantly for businesses that use the accrual method.

It’s possible the electrical energy consumed in October won’t be paid till December. Whereas it’d seem like accrued bills don’t have an result on cash flow as a outcome of money hasn’t modified hands yet—think again. They represent future money outflows, which can considerably impression your company’s liquidity and total monetary well being. This Coursera useful resource offers a useful breakdown of how accrued bills influence money flow. Past spreadsheets, consider using accounting software program to handle your accrued expenses. Many options supply options specifically designed for monitoring and automating accruals.

Why Choose Accrual Accounting On Your Business?

Many accrued bills recur often inside the regular course of enterprise. Assume of predictable, cyclical prices that are a part of your standard working procedures. Examples embrace property taxes, which accrue over time and are usually paid in installments. The unpaid portion represents an accrued legal responsibility, just like income tax. Payroll taxes, withheld from worker wages (like Social Security and Medicare), are additionally liabilities until remitted to the government. If your business pays sales commissions, these usually accrue all through a gross sales period but are paid later, creating one other recurring accrued legal responsibility.

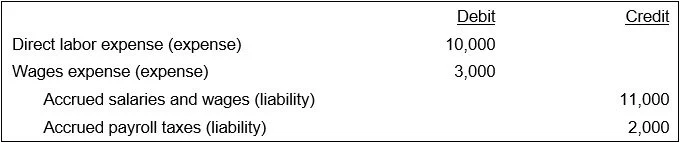

This occurs via a journal entry, which formally logs the expense and the liability it creates.Accurate journal entries are the spine of accrual accounting. This ensures downstream stories like your steadiness sheet and income statement stay aligned. Finally, do not assume accrued bills require no action until it’s time to pay. You Will have to https://www.simple-accounting.org/ make reversing entries to avoid counting expenses twice in the next accounting interval.

Journal Entry Instance 2 – Accrued Legal Charges

Coursera notes that taxes owed are a big example of accrued bills that businesses should rigorously track. It also demonstrates the firm’s dedication to transparency and compliance with accounting principles. It is essential for businesses to diligently account for accrued taxes to avoid any misrepresentation of their financial efficiency and obligations. Accrued revenue signifies the recognition of revenue that has been earned however not yet acquired by the tip of the accounting interval, necessitating correct reporting in monetary statements.

Managing accrued costs effectively is crucial for sustaining sturdy financial performance. Interest expenses can accumulate on outstanding loans or credit score balances, including to the entire liabilities. Salaries and wages which may be earned however not but paid at the end of the reporting period are additionally thought-about as accrued prices. If you run your business using cash accounting, you report expenses the second you pay for them, and you won’t have accrued expenses in your books. Whereas making use of the accrual methodology of accounting for your corporation, you have to take a few precautions. Since this technique of accounting is extra time-consuming, there’s a likelihood of misstatements if auto-reversing journal entries aren’t accurately used.

As ECOM CPA explains, accrued expenses reflect prices incurred however not but paid within the reporting period. On the earnings statement, accrued prices enhance expenses, reducing net income. On the stability sheet, they seem as liabilities, reflecting the duty to pay sooner or later. This strategy presents a extra comprehensive view of a company’s financial standing, providing stakeholders with useful insight into its performance and obligations. Operating a growing enterprise means preserving observe of quite a few expenses—some simple, others less so.

Accrual accounting is usually most popular to money accounting as a result of it offers a extra correct picture of an organization’s monetary well being. For occasion, if staff work in December however the company doesn’t pay them till January, those wages are recorded as an accrued expense in December. Whereas the accrual method and the popularity of accrued expenses offer significant benefits, it’s also necessary to be aware of the potential drawbacks. Understanding these challenges may help you implement strategies to mitigate them effectively. These characterize widespread situations of incurred yet unpaid bills on the finish of an accounting interval.